Child 18 in tertiary education. A Rated BBB Member.

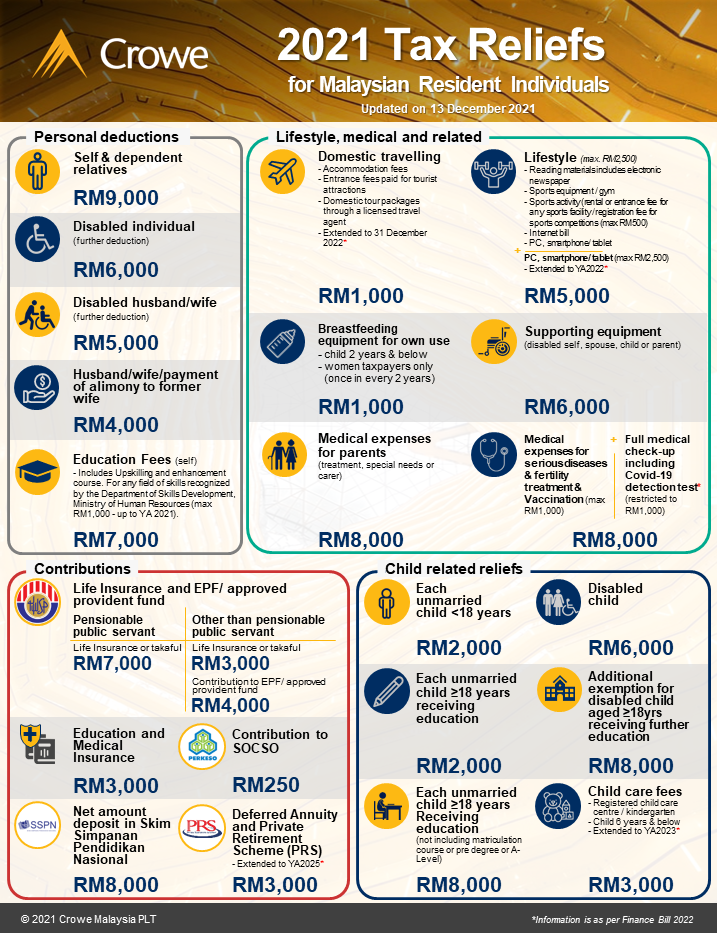

Malaysia Personal Income Tax Relief 2021

So the estimated total amount of my personal tax relief for YA 2018 is RM2146085 RM1836085.

. On the First 35000. Before you jump ahead and read all our juicy tax details weve also put together an easy infographic of. Education fee for tertiary level or postgraduate level.

Basically if you bought your house for RM500000 and then later sell it for RM700000 youll need to pay tax for the RM200000 profit you made. Tax Relief for Individual Spouse. Personal Tax Relief for YA2020 and YA2021.

This particular education tax relief in Malaysia is. Here are some of the other exciting financial perks you can enjoy in 2022. CuraDebt is a debt relief company from Hollywood Florida.

Get Instant Recommendations Trusted Reviews. On the First 20000 Next 15000. Dont forget to read up on our Ultimate Guide to LHDN Personal Income Tax E-Filing too.

Cant Pay Unpaid Taxes. Receive Options Quote With No Obligation. Compare Us Save.

Ad Tax Relief up to 96 Free Consult Get Your Qualification Options Now. For Year Of Assessment 2021 please refer to amounts in the Year Of. To include voluntary contributors and pensionable.

Medical expenses for parents. It was established in 2000 and has since become an active participant in the American Fair. Ad BBB A Rating.

Solve All Your IRS Tax Problems. Ad No Money To Pay IRS Back Tax. About the Company Lhdn Tax Relief 2021.

Ad No Money To Pay IRS Back Tax. On the First 5000 Next 15000. Income tax rebates for resident Individual are tabled below.

CuraDebt is a company that provides debt relief from Hollywood Florida. Children over 18 years old who are unmarried and receiving full-time education A-Level certificate matriculation or preparatory courses get tax relief of RM2000. Total Tax Charged RM20000 NONE NONE NONE Introduction TYPE OF RELIEF LIMIT Individual and dependent relatives RM8000 Disabled individual RM6000 Wifehusband RM3000 Disabled.

Expert Reviews Analysis. Ad Compare the Top Tax Help Services Get Help from a Qualified Professional wBack Taxes. To reduce your individual income tax make sure you fill the following columns in the Income Tax Return Form ITRF to qualify for deductions before submitting it to LHDN.

About the Company Tax Relief Lhdn. RM8000 tax relief for. You are entitled to an education tax relief of RM 2000 per child.

It was founded in 2000 and has been an active member of the American Fair Credit Council the US. Possibly Settle For Less. 24 rows Check how much tax youll save with the tax reliefs amount below.

28 rows Tax Relief Year 2020. Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to RM96000. Individual and dependent relatives.

Ad Client Recommended Services. In Budget 2020 an additional lifestyle tax relief for the purchase of personal computer smartphone or tablet for self spouse or child was added and extended to Year of Assessment 2021. The total tax relief is slightly less than my tax relief for the assessment year 2017 which.

RM 8000 per child. Lower municipal tax rate for four years in a row. Note however that the wording remains vague an extension may.

On the First 5000. Personal Tax Relief for YA2020 and YA2021. Property tax relief - NJ Division of Taxation.

For spouse without income. In December last year deputy. Limited 1500 for only one mother.

- As Heard on CNN. TAX RELIEF for resident individual i. So this wont apply to you if you only made a loss from your.

Piscataway Mourns the Loss of Favorite Son Kenny Armwood. Amount RM Self and dependent. LHDN In the latest changes taxpayers can also claim up to RM1000 for COVID-19 vaccination expenses for themselves their spouses and children.

Trusted by Over 1000000 Customers. Compare the Top Tax Relief Services and Find the One Thats Best for You. Malaysia Income Tax Relief.

Get a Free Qualfication Analysis. Ad See the Top 10 Tax Relief Services. Expansion of tax relief on EPF Contributions up to RM4000.

I Education RM 7000. Life insurance and EPF Up to RM7000 for life insurance public servants Up to RM3000 for life insurance and up to RM4000 for EPF for non. PENSIONABLE PUBLIC SERVANT CATEGORY Life insurance premium ii OTHER THAN PENSIONABLE PUBLIC SERVANT CATEGORY Life insurance premium.

Ii Spouse Alimony RM 4000. LHDN confirmed that taxpayers you would be able to claim tax relief for Covid-19 expenses for themselves their spouses and children in their assessment for 2021. A ringgit tax rebate will worth more to you than a ringgit of tax relief.

Tax Collector Township of. This special tax relief is provided on top of the existing tax relief for lifestyle purchases which is also set at RM2500.

Tax Relief For Year Of Assessment 2018 Plctaxconsultants

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Personal Tax Relief For 2022 Smart Investor Malaysia

Lhdn Irb Personal Income Tax Rebate 2022

Bantuan Prihatin Nasional Govt Fast Tracks Disbursement Of Cash Relief Finance Websites Fast Track Relief

Comparehero My Want To Reduce Your Income Tax For Ya 2020 Remember To Claim These Tax Reliefs For Our Complete List Of Taxrelief Tips Visit Bit Ly 3t1qwsq Taxseason2021 Lhdn Incometax Facebook

Infographic Of 2021 Tax Reliefs For Malaysian Resident Individuals Crowe Malaysia Plt

Incometaxmalaysia Instagram Posts Photos And Videos Picuki Com

Tax Relief Malaysia Everything You Can Claim In 2021 For Ya 2020

Personal Tax Relief For 2022 Smart Investor Malaysia

Lhdn Irb Personal Income Tax Rebate 2022

Lhdn Irb Personal Income Tax Relief 2020

Infographic Of 2020 Tax Reliefs For Malaysian Resident Individuals Crowe Malaysia Plt

Income Tax Of An Individual Lembaga Hasil Dalam Negeri